No products in the cart.

The Ichimoku indicator or Ichimoku Kinko Hyo is a multifunctional indicator that measures the momentum of price movement, shows support and resistance areas and trend direction. It is a powerful tool for trading and market analysis. Many traders feel depressed looking at all the lines and information that this indicator provides. That’s why they often misinterpret Ichimoku signals.

In this article, we will take a detailed look at this tool and show step by step how to use it correctly to make trading decisions.

The Ichimoku indicator was developed by Japanese journalist Goichi Hosoda before World War II. He later published his trading technique in 1969.

Ichimoku Kinko Hyo is a Japanese term that translates from English as follows:

- Ichimoku — “view”.

- Kinko — “balance”.

- Hyo — “Chart”.

That is, the balance of looking at the chart.

Let’s see how this indicator looks like and what it does.

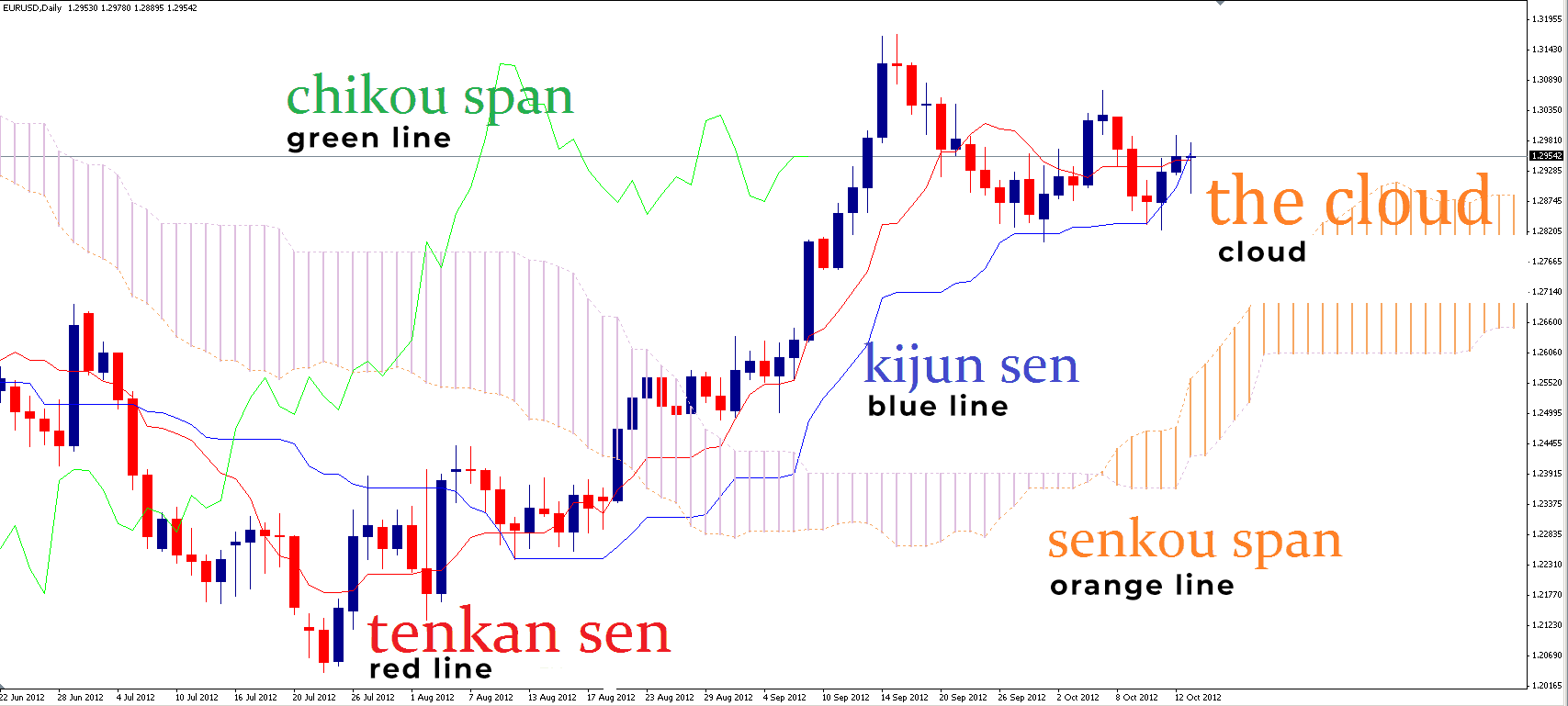

Ichimoku Indicator Lines

- Blue line (Kijun Sen) or baseline. Calculated by taking the average of the highest highs and lowest lows over the last 26 periods.

- Red line (Tenkan Sen) or turning line. It is calculated from averaging the highest maximum and minimum for the last 9 periods.

- Green Line (Chikou Span), which is a lagging line. This is today’s closing price, placed 26 periods behind

- Orange and purple lines (Senkou Span). The Senkou line is determined by averaging the Tenkan and Kijun lines and is plotted 26 periods ahead. The Senkou B line is calculated by averaging the highest high and low over the last fifty-two periods and is plotted 26 periods ahead.

- The cloud is located in the area formed by the Senkou A and B lines.

The Tenkan Sen and Kijun Sen lines look like moving averages, but they show an average of 9 and 26 periods of highs and lows. That is, they take the highest and lowest price levels during these periods, and then build a line in the middle of the range.

In the chart below, for comparison, we also plotted the moving average for 9 periods in white.

Despite the fact that the Ichimoku indicator includes five different lines, it is quite easy to read the price chart with it. You need to determine where the price is at the moment relative to the Senkou A or Senkou B lines.

As soon as the Senkou A or Senkou B lines are determined, the “cloud” component of the indicator will be darkened. When Senkou B is above Senkou A, it indicates to traders that the price momentum is currently upward. In this case, the Chart will be colored green.

On the other hand, when Senkou A is below Senkou B, the price is probably moving in a downward direction. When this happens, the cloud will be colored red. Despite the complexity of the chart, a simple look at the colors of the cloud can help you determine the direction of the market.

Signal lines of the Ichimoku indicator

- When Tenkan crosses Kijun from below, it is a bullish signal.

- When Tenkan crosses Kijun from above, it is a bearish signal.

- When the Chikou Span crosses the current price, it is a signal in the direction of the intersection.

The Tenkan and Kijun lines have two purposes. Firstly, they act as support and resistance areas during trends, similar to moving averages. Secondly, they provide information about the momentum of the price movement. When the price is trading above two lines and when the Tenkan line is above the Kijun line, it signals bullish momentum.

Ichimoku Cloud

The cloud is the main component of the Ichimoku indicator:

- When the price is above the cloud, it is a bullish signal.

- When the price is below the cloud, it is a bearish signal.

- When the price is in the cloud, the market is in a state of uncertainty

The Ichimoku cloud consists of lower and upper borders, and the space between the two lines is often painted green or red.

The upper boundary of the cloud or the Senkou A line is the average value between the Tenkan and Kijun lines. The lower, slower bound or Senkou B is the average value between the maximum for 52 periods. An important characteristic of the cloud is that it is projected for 26 periods in the future.

Since many lines on the Ichimoku Cloud chart are created using averages, its readings are often compared to simple moving averages. However, the Ichimoku indicator is more dynamic than simple moving averages.

In the chart below, I plotted two moving averages side by side and shifted them by 26 periods. You can see that the moving averages are almost identical to the Ichimoku cloud.

The general idea of the cloud is very similar to the Tenkan and Kijun lines, since its boundaries are based on the same principle. Firstly, the cloud acts as support and resistance, and also provides information about the direction of the trend and the momentum of price movement. But since the cloud uses 52 periods (as opposed to 9 and 26), it moves slower than the Tenkan and Kijun lines.

Basically, the cloud confirms an uptrend when the price is above the cloud, and a downtrend when the price is below the cloud. The space inside the cloud is a zone in which trading should be avoided. The uptrend increases when the cloud turns green, and the downtrend is confirmed by a red cloud. The cloud, therefore, is a way of trading on a longer-term trend.

Methods of trading on the indicator

With the Ichimoku Cloud, traders can easily choose between a long-term uptrend or a downtrend. When the price is below the boundaries of the cloud, it strengthens the downtrend and vice versa. During strong trends, the cloud also acts as support and resistance boundaries.

Thus, the cloud is ideal for filtering signals between bull and bear market phases. However, like most trend indicators, the Ichimoku cloud loses its relevance during consolidations.

The Tenkan and Kijun lines are the fastest moving components of the Ichimoku indicator, and provide earlier signals. In the Chart below, I have marked the numbers from 1 to 4, which we will go through.

- The Tenkan line crosses Kijun, which is a bullish signal. At that time, the price was also trading above both lines, confirming the bullish mood in the market. The price returned to the cloud for a moment, but found support. Here you can search for an entry point.

- The price has started to cross the Kijun line, which is a warning signal about a trend change. The Tenkan and Kijun lines also crossed into a bearish momentum, once again confirming the trend shift. Finally, the price entered the cloud, finally confirming the change in price movement in the market.

- The price crossed the Tenkan and Kijun lines, and the Tenkan line also crossed the Kijun line. All these are bearish signals. At the same time, the price was trading below the cloud. All these signals confirm a strong downtrend and can be used as entry points for selling.

- The price has started to cross the slower Kijun line, which is a warning signal. Then the Tenkan and Kijun lines continued to intersect, which once again confirmed that the price momentum is changing its direction.

The strength of Ichimoku signals is estimated based on three factors:

- How far is the price relative to the cloud?

- How far is Chikou Span relative to the cloud?

- How far is the intersection of the lines relative to the cloud?

Consider the combination of the RSI indicator with Ichimoku, which work perfectly together.

When using the Ichimoku indicator to track trends, it is important to understand when the current trend has ended and it is worth exiting the deal. The Chart below shows that by adding the RSI and searching for divergence with the RSI, reversals can be identified with high probability. If the price crosses the Tenkan and Kijun lines after the RSI divergence, a trend reversal in the opposite direction is very likely.

How can I place a stop loss and exit trades using the Ichimoku indicator?

Just like moving averages, the Ichimoku indicator can be used to place stop losses and exit trades. At the same time, it is important to consider several things:

- When the price crosses the Tenkan and Kijun lines during a downtrend, this may signal a temporary change in momentum, but as long as the cloud holds the price, the trend cannot be considered broken.

- When the price breaks above the cloud, the downtrend finally ends.

- Traders can use Ichimoku for conservative and aggressive exits from positions.

A conservative trader will exit his trades as soon as the Tenkan and Kijun lines intersect in the opposite direction to the ongoing trend. An aggressive trader will exit his trade only after the price breaks through the cloud in the opposite direction.

Let’s summarize the results

In general, the Ichimoku indicator is a very reliable all—in-one indicator that provides a lot of information. However, it is best to combine it with other tools, such as support and resistance levels, price action, as well as with the readings of other indicators.

To summarize, here are the most important things you should know:

- Use the cloud to determine the direction of a long-term trend. Trade only in the direction of the cloud.

- The cloud also acts as support and resistance during trends. But when the price enters the cloud, it signals a change in momentum.

- When the Tenkan line crosses the Kijun, it may signal a price shift towards a bullish trend.

- During a trend, Tenkan and Kijun act as support and resistance.

- Trade only in the direction of the Tenkan and Kijun lines.

- A trader can either use the Tenkan and Kijun lines for stop losses, or exit when the price breaks through the cloud.

- During consolidations, the Ichimoku indicator becomes useless.

Ichimoku Cloud and Moving Averages

Let’s compare the Ichimoku indicator with moving averages and try to understand their advantages and disadvantages.

Let’s look at the chart below, on which three exponential moving averages (EMA) are built: a 10-day EMA (representing a short-term trend), a 50-day EMA (representing a medium-term trend) and a 200-day EMA (representing a long-term trend).

Before we delve into the analysis, let’s compare the functionality of both indicators:

Despite the fact that both indicators are quite similar, there is a certain difference between them. The best way to compare two indicators and understand the difference between their functioning is to apply them to the same set of trading instruments.

Let’s analyze gold futures with three exponential moving averages (EMA).

Now let’s try to apply the Ichimoku indicator.

The differences between the indicators reveal a discrepancy between Ichimoku and EMA indicators. What is important here is not that they do not correspond to each other, but how they differ in terms of interpretation of past and projected price movements.

Let’s analyze the price events filtered by the Ichimoku cloud.

Let’s try to overlay the analysis of the Ichimoku indicator on top of the original EMA chart.

You can see how the short-term EMA sometimes crosses the medium-term EMA, often giving us a false signal. For the Ichimoku cloud, the readings are not as detailed as in combinations of moving averages.

Two traditional trend signals characteristic of this combination of moving averages are a bearish “Death Cross” (where 50 EMA crosses 200 EMA from top to bottom) and a bullish “Golden Cross” (where 50 EMA crosses from bottom to top above 200), which we can clearly see on the chart. Ichimoku had indicated a trend change much earlier, thus providing some advantage. Similar to the EMA, cloud support coincided with the 50 and 200 EMA.

The strength of the trend can be estimated using only one indicator. If the moving average moves up steeply, then we can assume that the trend is relatively strong. A flat moving average may indicate trend indecision. A moving average pointing downwards indicates a pronounced downtrend. What can be useful when using three moving averages is that you can see the strength of the short-term and long-term trend direction, and how much one can be stronger than the other.

There are many more differences that can be found between both indicators. One tool cannot provide an exhaustive sample for comparison. Now that you have learned about the differences in some details, I recommend that you continue to study the differences between them.

Ichimoku Indicator – Trading strategy

We are waiting for the moment when the price will be above the cloud. This is a bullish signal and possibly the beginning of a new uptrend.

We are waiting for the Tenkan-Sen line to cross and close above the Kijun-Sen line.

We enter the long after crossing the lines at the opening of the next candle.

We place a stop loss below the breakdown candle.

We will fix the profit when the Tenkan-Sen line crosses the Kijun-Sen line.

Let’s also consider an example for sale.

How to automate Ichimoku trading

Ichimoku MNTrader strategy is a fully automated trading system. Trading is based on the Ichimoku Kinko Hyo indicator, patterns and zigzag to filter the false signal to build more accurate analysis uses Renko charts. Suitable for all futures and Forex trading instruments.